Interested about the latest developments in alternative proteins, plant-based meat, milk and yogurt in China?

Since 2021, we have been publishing a public report annually to explain the product categories, trends, challenges and opportunities for alternative proteins in China. The industry has been evolving and restructuring amidst changes in post-pandemic economy, consumer needs and agrifood industry trends.

Asymmetrics Research’s latest edition, China Alternative Protein Products Market Landscape Report 2023 takes the pulse of the current market context, product categories, industry trends, leading brands and product forms, challenges and outlook.

We aim to tell the story not only “as it is”, but also why it is and what else needs to be done.

Reports are available in English and Chinese.

Key Takeaways

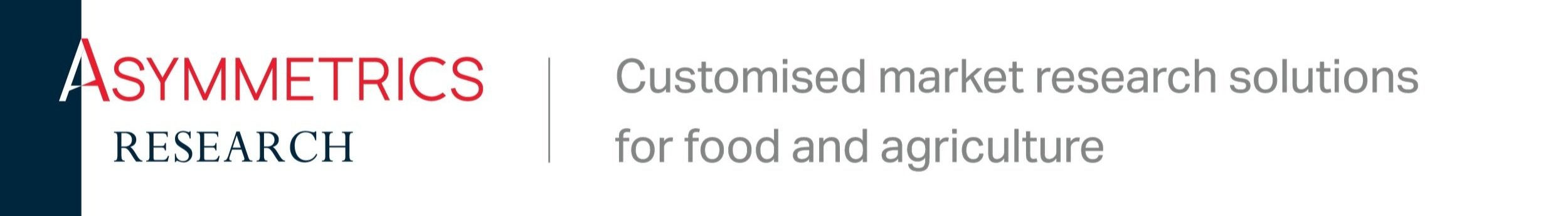

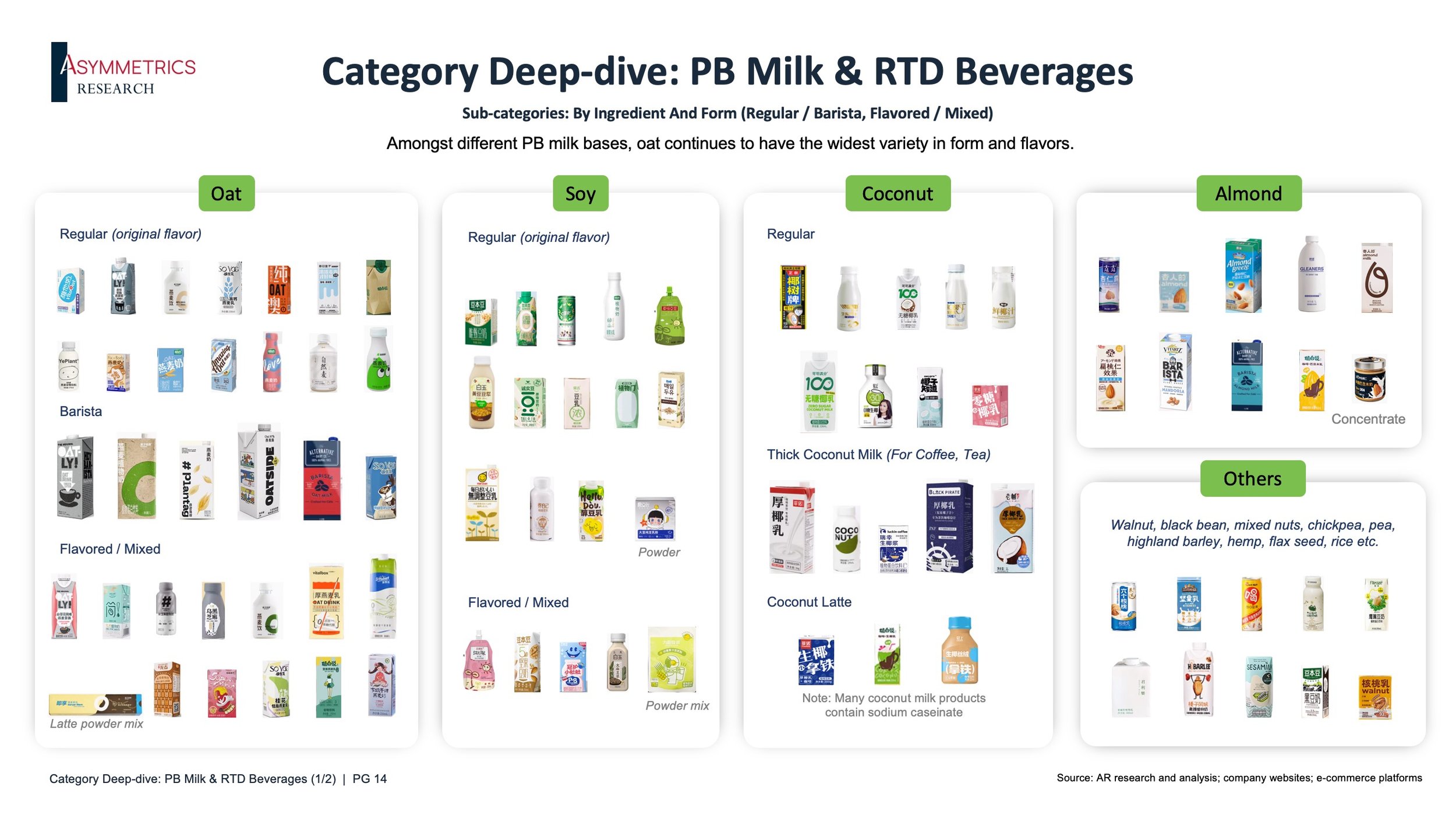

Plant-based milk and ready-to-drink beverages, yogurt and ice cream, “meat” and prepared meals, “meat” snacks, and protein functional foods are key active categories sold in the market. Plant-based ice cream has emerged to expand PB dairy application on a commercial scale.

The plant-based meat and milk categories especially have seen restructuring and attrition of players. Players are controlling costs, and adjusting portfolios and brand positioning. Some are diversifying across categories to target specific consumer segments and consumption scenarios.

Plant-based brands are targeting health and conscious eating trends. For example, many plant-based milk and ready-to-drink beverages highlight having no cane sugar and some have added functional ingredients. For the plant-based meat and prepared meals, consumers’ concerns include taste, mouthfeel and additive level; clean label (simple ingredient list) is a growing food trend which brands should pay attention to.

Investment in alternative proteins has generally been slower in 2023 amidst tough fundraising and macro conditions. Recent larger deals have been in cell-based culture and fermentation start-ups.

New fermentation technology can be harnessed to produce microbial biomass using yeast, microalgae or mycelium through biomass fermentation, or to produce functional ingredients using precision fermentation. The segment will need to overcome regulatory approval, expand product applications, scale up production and gain consumer understanding.

In cell-based culture, the number of companies has grown in the past two years, albeit from a small base. The top challenges for this segment are to reduce costs and scale up production, obtain regulatory approval, and in the longer run gain consumer acceptance.

Ultimately, alternative protein players need to provide tasty and high-value offerings which fulfil target consumer segments’ health and nutritional wants in the shorter term, and expand technology and application possibilities aligned with policy directions in the longer term.

Missed our earlier reports?

If you missed our 2022 or 2021 reports, you can also make a request, for English or Chinese versions.

Obtain your free copy now

Available in English and Chinese. For the full report, please fill in the contact form, and we will email you a free copy of the report.

请提供联系信息免费领取完整版报告,下载信息将发送到您的邮箱。